Daily sales by airport food and beverage and retail concessionaires in the U.S. have stayed stubbornly below $5 million throughout the month of April as the COVID-19 pandemic continues to ravage the industry.

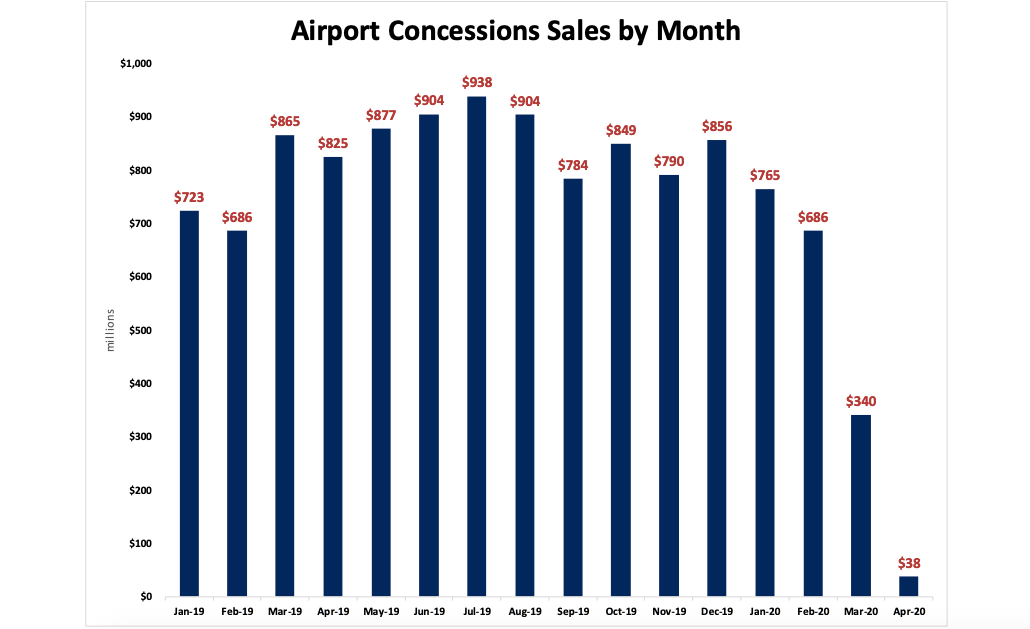

Concessionaires, through the Airport Restaurant & Retail Association (ARRA) trade group, released data showing the stark reality of their collective financial situation. In March, concessions sales were off by about 60 percent, falling to $340 million compared to $865 million in the same month a year ago. April was far worse, with collective concessions sales coming in at an estimated $38 million, compared to $825 million in April 2019, according to ARRA.

With sales at less than 5 percent of normal, “companies have had to go into hibernation,” said Rob Wigington, executive director of ARRA, speaking on the group’s weekly industry conference call. “For those of you who may have been through an airport in these times or are working at an airport, you know what that looks like. But unlike bears, you can’t sleep through it and expect everything to be okay when you wake up in this business.”

In a white paper that accompanied the call, ARRA noted that there are two “very significant barriers to their successful hibernation.”

First, the concessions industry is heavily debt laden. ARRA noted that the capital required to build airport concessions has skyrocketed in recent years, with major cities hitting $1,000-plus per square foot for airport concession construction. Principal and interest payments for an operation are typically 10‐12 percent of the sales of a business.

Second involves the minimum annual guarantees and rent payments required by nearly all concessions contracts. “Without passengers, payment of these costs is not feasible,” the white paper noted. “Rent can be 15 – 20 percent of sales during normal circumstances. Rent is transformed from a normal expense to an insurmountable mountain when passengers disappear.

“If operators are required to pay rent with no sales for any period, all operators will eventually fail,” the paper went on. “The only differentiating factor will be the exact moment when each company drains its cash resources.”

Wigington urged collaboration. “We hope each of the concessionaires has the opportunity with each of the airports to sit down and run their business scenario so [the airports] understand exactly what the dire situation is that concessionaires are facing, and what they need the airport to do to help them get through this.”

Two industry consultants – Eri Kircherer and Kent Vanden Oever – served as panelists on the call, sharing their insights on the current crisis.

Kircherer said “headwinds” were evident even prior to the pandemic, citing capital investments “hitting the stratosphere,” lengthy operating hours and competitive pressures on rents and operating costs. “That cake was baked and that bill is due,” he said, in reference to the past financial requirements from concessionaires.

The problem isn’t going to be solved any time soon, he added. “Whether you’re an ACDBE, a prime or a local chef with one location, the math and the impact of the zero sales [is clear]. From my perspective, whether it’s zero, 5 percent, 3 percent, that’s essentially zero sales. And, and even if sales recover, even if sales recover to 30 percent or even 50 percent, it’s unsustainable.”

Kircherer pushed for a change in approach. “I do hope that airports can start to appreciate that, without some radical change to the revenue model, the end result is the same and these businesses will not be able to continue it,” he said. “It’s really only a matter of time and time and how quickly or how much cash is on hand and how quickly those cash reserves are depleted.”

Vanden Oever predicted a slow return to previous passenger traffic levels – ranging from one to three years – causing distress for companies that might have enough cash reserves to get through three to six months of no sales or low sales, but can’t hold out much longer than that.

“I don’t know how many [concessionaires] are still going to be around,” Vanden Oever said. This should be – and I think it probably is for the airports that are listening – just as scary as the financial picture is. What if 15 months from now I find myself at 50 percent traffic, but 80 percent of my units are closed because the companies are just gone?” He added that with airports’ typically lengthy procurement processes, it would take time to fill the void.

Vanden Oever also noted that small businesses may be more skittish to take on the kind of risk that airport businesses require, which could hamper the continuing trend toward local representation in airports.