Airports have shown stability in the wake of continuing upheaval caused by Covid-19 variants, said Seth Lehman, senior director for airports at Fitch, the ratings agency. Speaking on a Fitch webinar Friday, Lehman said the solid airport performances are reflected in the ratings.

“We began 2021 with rating outlooks for most credits in airport sector at negative, but these have these evolved to stable for all but a few small market airports,” he said. “The industry recovery was probably the most important main driver, but we also take to account management actions for the preservation of liquidity and how much the federal award monies were received and how they were used.

“Absent any major setbacks, Fitch expects to stabilize more airport-related ratings in the coming months as demand continues to recover and effective management practices are adopted,” he added.

Sluggishness in business travel is impeding full recovery, Lehman noted.

“Currently our view is that the business travel is more likely to be pushed back a bit in terms of recovery, where maybe the next big step up from where we are today will be in the second half of 2022,” he said. “I think there’s still a lot of caution until there’s a sustained period of virus counts going to much lower levels.

“Within business travel … certainly we think the domestic side will be a lot faster in the recovery because there are really very few limitations…” Lehman continued. For international business travel, the requirements for testing remain a barrier, and the uncertainty surrounding the outcome of the test makes travelers cautious. Lehman added that he doesn’t believe there will be significant, long-term structural damage to business travel.

While not knowing what’s ahead, Lehman said he believes the industry will weather any future variants based on past experience. “We had Delta and the Omicron variants and the recovery curve kept moving forward – there was no major setback from the variants,” he said.

Lehman added that Fitch considered but ultimately rejected a more conservative approach to airport ratings in light of the uncertainty. “So far we don’t have the evidence to say a variant, even after Omicron, would be a disruptive event. We feel comfortable that it’s not going to be a move-the-needed situation, at least in the coming months.”

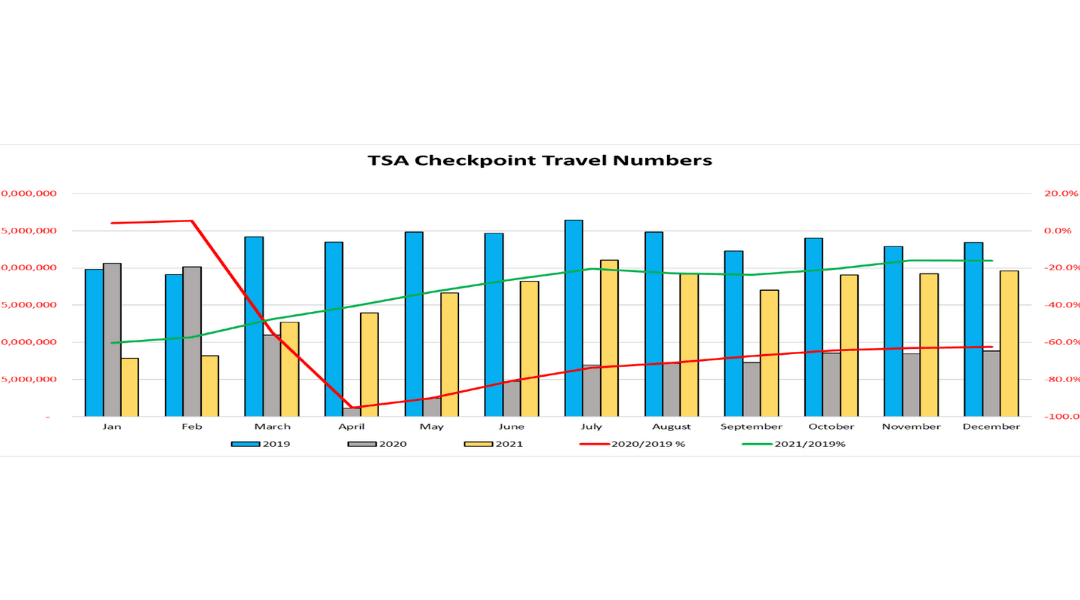

Referencing airport performances in 2021, Lehman noted that the rate of passenger comeback varies by airport but the clear takeaway is that people are still keen to travel.

“There has been remarkable stability in the numbers throughout the second half of last year, despite the successive waves of the Delta and the Omicron variants,” Lehma said. “People wanted to travel – there was too much Zoom fatigue, perhaps – and the airlines for the most part were more agile setting up their flight operations to follow demand.

“Performance at the individual airport level depended largely on the market itself and the role of the airport,” he continued. “We have consistently commented how leisure destinations outperformed the business sector-centered markets and the international gateways. All of that seems to counterintuitive, to a degree, to the old perceptions that leisure markets would see more volatility in slower recoveries in time of stress.”

Lehman said that among large-hub airports, Orlando International (MCO), Las Vegas’ Harry Reid International (LAS), and Phoenix Sky Harbor International (PHX) were among the top performers for 2021, while among smaller airports there were “shining stars” such as Myrtle Beach International Airport (MYR) and Boise Airport (BOI), due to relocations and leisure travel gains. On the down side, some of the nation’s largest connecting airports had mixed performances. Dallas/Fort Worth International (DFW) and Denver International (DEN) airports held up well as connecting facilities while Los Angeles International Airport (LAX), John F. Kennedy International Airport (JFK) and LaGuardia (LGA) still have much more to go to recover portions of their core travel base, such as the business and international market.