Fitch Ratings shared its current assessments of both airports and airlines in North America and its expectations for the industry going forward in a company-hosted webinar Thursday.

The webinar, titled Fitch North American Airports/Airlines Update, featured Fitch executives Seth Lehman, senior director for North American airports, and Joseph Rohlena, senior director for North American airlines.

Lehman noted that U.S. airports as a group are performing much better than their Canadian counterparts. “TSA screenings in the United States on most days have been ranging from 68 percent to 75 percent of the volume seen in 2019,” he said. “On the flip side, the traffic in Canada across all airports remains extremely weak.”

Within the U.S., the best performers are those airports that serve established leisure destinations or are located in states with more relaxed policies.

“The large-hub airports that have typically shown the least – in terms of peak to trough – volatilities during past downturn cycles are the ones that are still lagging their recovery performances, but the markets are also the ones that have the most influence by the international passenger traffic,” Lehman said. “Fitch believes that in the coming months we will see a potential narrowing of these recovery gaps as the vaccine rates continue to rise and the most affected areas of economy within these markets are restored to a normal state.”

Fitch assesses a combination of concurrent strategies taken by airports. The first emergency federal funding awarded to airports in 2020 allowed airports to avoid downgrades, Lehman said, while the second and third bailouts “should provide a longer backstop to the revenue losses we still anticipate for the next one to two years.”

Many airports waived rents or altered lease terms for tenants during the pandemic. “So far, we do not believe the actions we observed regarding payment terms as long-term credit-negative events…” he said, noting that such actions didn’t cause payment defaults or trigger violations of bond covenants. Airports also embarked on refunding efforts to garner savings for the immediate term rather than throughout the term of the bond, a move Lehman said does pose some risk given the uncertainty of the aviation environment.

Airports are also taking steps to strengthen their working capital liquidity options, he noted. “Given that you never know when you may have a recurrence of a crisis such as this pandemic… these actions serve well from a credit perspective.”

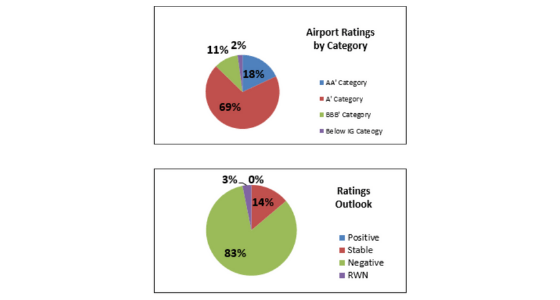

More than two thirds of North American airports are rated “A” by Fitch, reflecting the long-term viability of the sector. But given the current volatility in the market, the vast majority of airports (83 percent) are designated “ratings outlook negative.”

Lehman said in the coming weeks and months Fitch will focus on three key areas.

The agency will continue to monitor the pace of traffic recovery and assess the likelihood over the upcoming 12 months whether the airport is likely to meet or outperform Fitch’s enplanement assumptions that guide its ratings. Also, the “ability of airports to re-establish their revenue models within a reasonable time frame” will be assessed as a sign of predictability. That includes lease agreements with concessionaires, rental car companies and airlines, he said.

“We also note that airports have kind of taken defensive measures on expenses and capital spending,” Lehman added. “We will look to airports’ ability to transition their budgets in these areas as recovery continues.”

Finally, Fitch will also assess a forward-looking financial profile using a variety of metrics, he said.

On the airline side, Rohlena said leisure-focused airlines are expected to fare better in the early stages of recovery. Other business areas are problematic. “Airlines at this point are generally reporting business travel down in the 75-80 percent range from 2019, which obviously has a bigger impact on the network carriers,” he said, adding that “things are still much more difficult for the Canadian carriers due to slower vaccine rollouts and strict travel restrictions in Canada.”

Rohlena said all airline ratings are down by at least a notch and sometimes more, compared to pre-pandemic. “Between the debt raised and the previously unencumbered assets that have been borrowed against, it’s pretty clear that the level of risk for all of the airlines is higher than it was prior to COVID,” he said.

Going forward, the big question mark will be business and international travel, since leisure traffic is already well in the recovery stage. “As we’re looking towards the second half of this year, if [business and international travel]is it coming back quicker than we were expecting it to, or at least on trend, that’s something that could support stable outlooks going forward.”