While gifting continues to be part of the equation in travel retail and duty free, there has been a significant shift towards people buying for themselves at the cost of gifting, and self-indulgence is now the main motivation and purpose for purchasing in travel retail, according to new data released by travel marketing intelligence and consulting firm m1nd-set.

M1nd-set found that the pandemic prompted significant changes in how travelers shop. “Whether for economic reasons or because the product mix seemed less relevant since the pandemic, gift shopping has been severely impacted in the travel retail environment,” the company said in its report. “More self-serving shopper behavior has emerged since the pandemic as a consequence.”

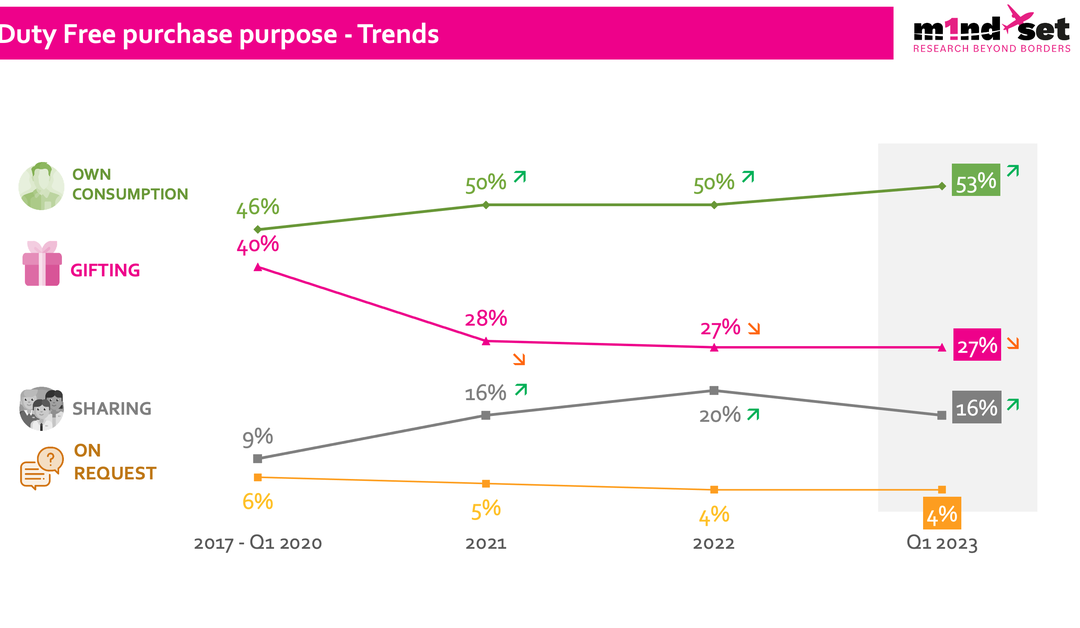

Prior to the pandemic, between 2017 and Q1 2020, 40% of global shoppers said they purchased in travel retail for gifting, the data showed. Since the pandemic, only 27% of shoppers in travel retail purchased an item for gifting in 2022 and in Q1 2023. Self-purchases increased from 46% to 53% between the pre-pandemic period and Q1 2023. Purchases for sharing have also increased; from 9% between 2017 and Q1 2020 to 16% in 2021 and 20% in 2022 before falling again to 16% in Q1 this year.

The decline of gift shopping in travel retail has been more severe in the Americas and Europe compared to other regions. In the Americas, the percentage of shoppers purchasing gifts in travel retail has fallen 15% since the pre-pandemic period when 41% of shoppers in the Americas purchased gifts in travel retail, to 26% in Q1 2023. In Europe, the impact of the pandemic on gift shopping in travel retail has been the most severe with a 20% decline, from 40% pre-pandemic, between 2017 and Q1 2020, to 20% in Q1 this year.

By demographics, the strongest decline in gift shopping is among middle-aged shoppers; only 28% of middle-aged shoppers purchased gifts in Q1 2023, a 13% decline from the pre-pandemic level. The drop in gift shopping among Seniors and Millennials was slightly less sharp, with an 11% decline among both segments, from 43% to 32% among Seniors and 35% to 24% among Millennial shoppers. The weakest decline in gift shopping among the age segments is seen among Gen Zs – having fallen from 31% prior to the pandemic to 24% in Q1 this year.